Key elements of high-performing deposit return systems:

#9 - Recycled content requirements

In this System Spotlight article series, TOMRA provides a deep dive into the best practices of high-performing container deposit return schemes.

Ocean plastic pollution, waste management costs and mandated collection targets are causing more and more governments to make sustainable resource management a priority. One policy that is actively being discussed is the concept of giving waste a value, to incentivize the public to collect it for recycling. This is a particularly popular approach for the items that are most commonly littered and found in oceans, such as beverage containers. Container deposit return systems (or “bottle bills”) add a deposit on the container on top of the price for the beverage, which is repaid when the consumer returns it to be recycled. A number of states or countries have committed to update existing deposit systems or develop new systems.

Ocean plastic pollution, waste management costs and mandated collection targets are causing more and more governments to make sustainable resource management a priority. One policy that is actively being discussed is the concept of giving waste a value, to incentivize the public to collect it for recycling. This is a particularly popular approach for the items that are most commonly littered and found in oceans, such as beverage containers. Container deposit return systems (or “bottle bills”) add a deposit on the container on top of the price for the beverage, which is repaid when the consumer returns it to be recycled. A number of states or countries have committed to update existing deposit systems or develop new systems.

In this ongoing article series and its white paper, "Rewarding Recycling: Learnings From the World's Highest-Performing Deposit Return Systems", TOMRA explores the best practices that separate the leaders in deposit return systems from the laggards.

Key Element #9: Recycled content requirements

As TOMRA stated in its Resource Recovery Playbook, decoupling economic growth from resource extraction is a critical challenge for regulators today. If all plastic packaging were to be recycled into lower-quality applications, the packaging industry would nonetheless remain dependent on input from virgin materials, such as oil.

Pressure is growing on beverage producers (and indeed all FMCG producers) to reduce the environmental footprint of their packaging. Many have responded by setting ambitious targets to use more recycled PET (rPET). However, brands have found it challenging to deliver on that promise.

In 2019, Coca-Cola stated that it uses 9% post-consumer recycled content as a percentage of its total global plastic packaging volume, by weight. PepsiCo used 3% (2020) and Nestle used 0.2% (2018).

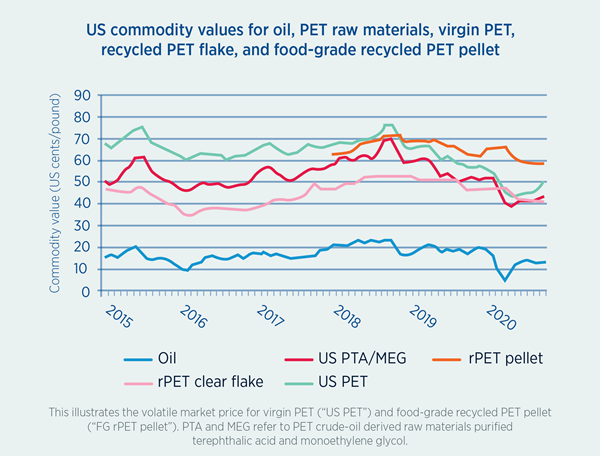

Part of the challenge comes down to cost. Market volatility occasionally means food-grade rPET costs more than virgin PET, which places the sustainable option at a cost disadvantage. For example, in January 2018 the price of food-grade recycled PET was 7% cheaper than virgin PET, but by mid-2020 it was around 35% more expensive (see diagram)

Another barrier is simply a lack of supply of high-quality recycled material for the production of new drink containers. Jon Woods, General Manager, Coca-Cola Great Britain, said: “One of the key challenges the industry currently faces is that there isn’t enough food-grade recycled plastic locally available in the UK to switch to 100% rPET across our entire range. There needs to be more high-quality recycled plastic produced, so it’s vital to make sure we collect more bottles in an efficient way, and stop it ending up as waste.”

In order for US beverage producers to meet a minimum of 50% recycled PET content, for example, the National Association of PET Container Resources (US) has estimated that the national recycling rate for PET bottles would need to rise to over 70%, up from 29% in 2019.

“Plastics recycling needs a high-priced virgin polymer environment to be economically viable on a standalone basis,” states the research firm S&P Global. When recycled plastic is more expensive, producers would be pressured to opt for the cheaper virgin PET option. While some larger beverage producers (notably those which have made public sustainability commitments) may continue to purchase rPET (up to a point), smaller brands with less public exposure may switch to virgin. Indeed, producers reverting to virgin resources has been documented on numerous occasions, even with pledges to manufacture bottles with more recycled content.

The unpredictable market value of virgin plastics creates risks for those evaluating investments in enhanced collection, processing and final recycling of plastic waste. To truly drive a circular economy, well-designed policy frameworks and regulatory instruments are vital. Pew Charitable Trusts, which published a landmark 2020 study on interventions needed to meaningfully reduce ocean plastic pollution, acknowledged the lower demand for recyclable material. It recommended “mandating the use of recycled content to increase demand for secondary materials.”

Steve Alexander, CEO of the Association of Plastic Recyclers (APR), added that recycled content mandates are a “critical step forward” which “monetizes the entire waste management system.”

There is also a knock-on effect on energy to consider. All decarbonization pathways highlight the need to switch to low-carbon energy sources and to reduce the demand for energy. By increasing the use of recycled content, society would reduce the energy consumption associated with extraction of raw materials and production of containers from scratch.

This is why it is so important to collect, sort and process materials for recycling in such a way that their quality enables them to be reused again and again.

Deposit return systems are uniquely built to offer a large supply of clean, high-quality material to meet these requirements for recycled content. This is largely due to the low risk of contamination – i.e. other material polluting the material stream, and thereby reducing its quality. For example, in the U.S., PET post-consumer bales collected and processed through a deposit return system have a value approximately 40% higher than PET collected in a curbside program.*

In the context of a deposit system, setting recycled-content minimums, such as requiring PET beverage bottles to be manufactured with 30% recycled content by 2030 in the case of the EU’s Single-Use Plastics Directive, provides another benefit: cost reduction. If recycled content requirements are established, this would signal to the markets that the demand for recycled material is consistent, which should stabilize its value. S&P analysts suggest voluntary pledges from beverage producers for the use of recycled content have already helped to stabilize the market value of food-grade rPET, though continued investments on this scale are not guaranteed.

Since most deposit systems allow producer-funded Central System Administrators to use the sale of collected material as a revenue stream, this stabilized price would support the overall cost efficiency of the deposit system, and at the same time encourage producers to decouple economic growth from resource extraction.

System Spotlight

European Union:

The EU’s Single-Use Plastics Directive was designed to target the most commonly littered items on European beaches, as part of the effort to reduce ocean plastic pollution. To incentivize the collection and recycling of valuable plastic resources, the legislation established recycled-content mandates for plastic beverage containers, setting a 25% target for recycled content in PET bottles by 2025 and 30% for all plastic bottles by 2030. The Directive also mandates a 90% target for the separate collection of plastic beverage bottles by 2029.

California, USA:

Upon signing the world’s most ambitious recycled content law for beverage containers to date, Governor Newsom explained, “California has long led the way on bold solutions in the climate space, and the steps we take today bring us closer to our ambitious goals.”

The law requires plastic beverage containers subject to a deposit (“California Refund Value”) to include 15% recycled content by 2022, 25% by 2025, and 50% by 2030. The state already had in place minimum recycled content requirements for glass containers, rigid plastic packaging containers, newsprint, trash bags, and other products.

New South Wales, Australia:

Investing in PET sorting and recycling facilities carries significant risk, largely due to a lack of security over infeed material volumes and the volatile market price of rPET explained above. To reduce the risk involved in such an investment, in New South Wales beverage producer Asahi and packaging manufacturer Pact committed to purchase a certain amount of food-grade PET pellets and hot-washed PET flake, should a facility be developed.

With this guaranteed assurance of a customer, Asahi, Pact and waste management company Cleanaway formed a joint venture, Circular Plastics Australia, to co-invest in a plastic pelletizing plant that would provide high-quality recycled content. The New South Wales government also provided a supporting grant and the deposit system Network Operator, TOMRA Cleanaway, provided a long-term supply agreement.

This agreement ensures that the Network Operator has a guaranteed customer for plastic materials collected through the deposit system, Circular Plastics Australia has certainty of feedstock for its sorting plant and certainty of sale of the sorted product, and Asahi and Pact have certainty over access to a scarce resource that helps the companies reach sustainability commitments.

The facility is expected to increase the amount of locally-sourced recycled PET from 30,000 tons to 50,000 tons a year. It will be partly powered by solar energy, creating 300 direct and indirect jobs in its construction.

* RecyclingMarkets.net lists baled PET market value data from deposit streams as 58% to 93% higher than baled PET from non-deposit streams. This refers to deposit vs non-deposit PET in the northeast USA, January-June 2020. Susan Collins of the Container Recycling Institute commented that this is higher than normal due to COVID-19 implications and deposit PET is typically 40% higher.