Key elements of high-performing deposit return systems:

#3 - Return-rate target

In this System Spotlight article series, TOMRA provides a deep dive into the best practices of high-performing container deposit return schemes.

Ocean plastic pollution, waste management costs and mandated collection targets are causing more and more governments to make sustainable resource management a priority. One policy that is actively being discussed is the concept of giving waste a value, to incentivize the public to collect it for recycling. This is a particularly popular approach for the items that are most commonly littered and found in oceans, such as beverage containers. Container deposit return systems (or “bottle bills”) add a deposit on the container on top of the price for the beverage, which is repaid when the consumer returns it to be recycled. A number of states or countries have committed to update existing deposit systems or develop new systems. In this ongoing article series and its white paper, "Rewarding Recycling: Learnings From the World's Highest-Performing Deposit Return Systems", TOMRA explores the best practices that separate the leaders in deposit return systems from the laggards.

Key element #3: Return-rate target

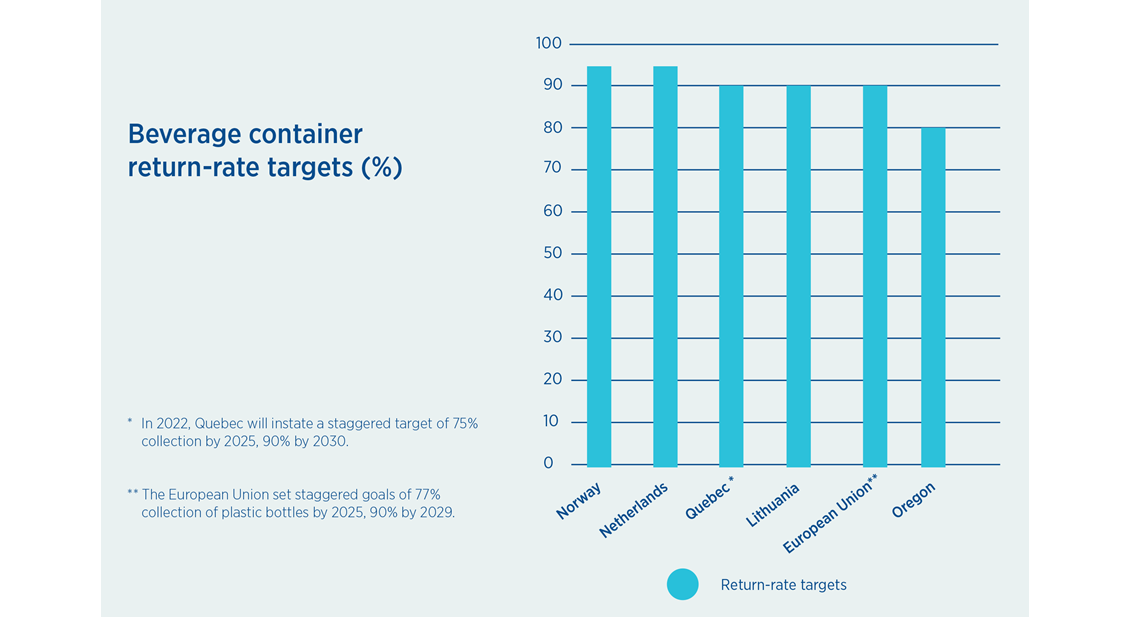

High-performing deposit return systems (DRSs) are generally considered to be programs where at least 85% of the containers sold are returned for recycling. This is known as the return rate. The key to achieving these high return rates is through setting a deposit value that’s of worth to the consumer, and ensuring they can redeem their containers easily.

It is important to note that inflation pressures on the deposit value or a reduction in redemption locations may weaken this return rate. If money from “unredeemed deposits” is also a significant revenue stream for the organization tasked with managing the DRS, such as a producer-run non-profit, this can encourage prioritization of income over maximizing the collection and recycling of containers. To overcome this, many DRSs set a return-rate target. This target not only helps create a common goal for regulators, producers and retailers to work towards, but also ensures the ideas of design, investment and the data management approach between stakeholders is cooperatively aligned.

It also enables producers to maintain their “license to operate” to manage the program, ensuring some flexibility over setting fees and maintaining the unredeemed deposits to help finance the program. Governments can also set penalties at a level that properly incentivizes compliance. This includes taxes, delisting products or implementing a “trigger” to automatically raise the deposit value, which can help ensure a fair playing field for brand owners and raise the return rate.

System spotlight

Massachusetts, USA:

Without a return-rate target and penalties associated with underperformance, producers lack incentives to improve a deposit return system at scale. This is evident in Massachusetts, which provides a good example of the poor performance that can result when a target is not set.

In 2020, Massachusetts had a return rate of 43%, making it the lowest return rate in the world.1 The state has a very low deposit value of US$0.05 (€0.04) compared to other DRS markets, which inhibits its ability to incentivize consumers to return their containers. The value of the deposit has not increased since the law was implemented in 1983. Unredeemed deposits are diverted to the government rather than going back into the DRS, which may incentivize the regulatory body to keep the return rate low.

Oregon, USA:

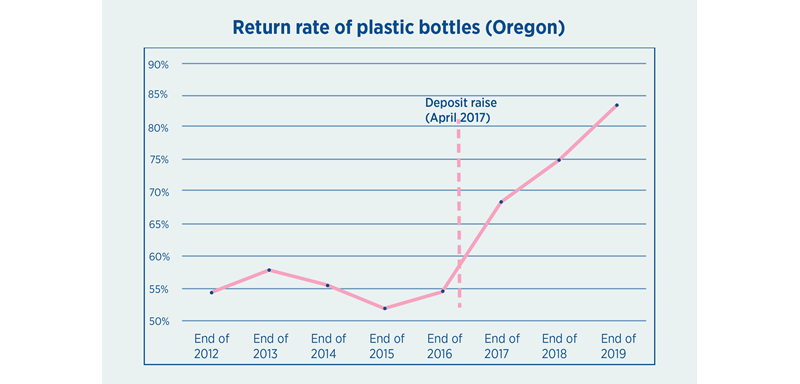

Although the state now has a return rate which exceeds 85%, Oregon’s deposit return scheme was in decline prior to 2008. Changes were proposed by advocates to improve return rates and modernize the program, such as adding new beverage categories, raising the deposit value, and reverting to the state the unredeemed deposits that were not being invested into redemption infrastructure.

A compromise created the beverage-industry-owned Central System Administrator (CSA) known as Oregon Beverage Recycling Cooperative, to manage the deposit system, while also creating a “trigger” mechanism to raise the deposit value if the redemption rate fell.

After return rates in 2016 fell below 80% for two consecutive years, the deposit value was automatically raised from five to 10 cents in 2017. This resulted in an increase in overall return rates from 64% in 2016 up to 86% in 2019, and an increase in plastic bottle return rates from around 54% in 2016 to 83% in 2019, a 53% increase.

Setting a return rate to enable a high-performing DRS

Setting a return-rate target for a deposit return scheme is integral to its performance. Not only does this target serve as a performance benchmark for the program as a whole, but it serves as a common goal for retailers, producers and regulators to work towards, by aligning decisions regarding data management, system design, and investment.

Image credit (below): Sophie Dingwall, eXXpedition